The Jammu & Kashmir High Court recently set aside an order passed by the State Consumer Disputes Redressal Commission, stating that the Commission’s decision was "bereft of any reasons" and rendered without giving the insurance company a fair chance to present evidence against the claimant’s case.

Background of the Case

The dispute involved an insurance claim filed after the death of the insured, Abdul Majeed Khan. The insurance company, MetLife India, rejected the claim, alleging that the deceased had concealed a pre-existing heart condition when purchasing the policy. They argued that this amounted to fraud and misrepresentation, voiding the insurance contract.

Read also:- Allahabad High Court Slams Police Intimidation of Lawyers, Orders Strict Action in PIL Harassment Case

The Consumer Commission, however, allowed the claim based solely on the claimant’s statement, without permitting the insurance company to present key witnesses, including an investigator and a medical officer, who could have substantiated their defense.

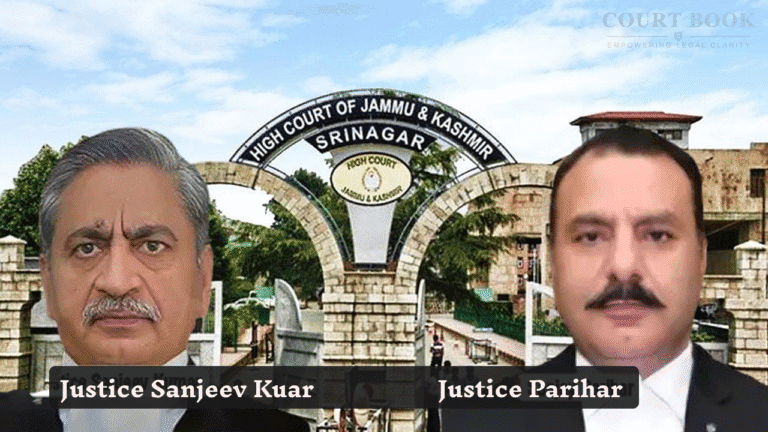

A Division Bench comprising Justice Sanjeev Kumar and Justice Sanjay Parihar held:

"Merely because the Commission is created for summary disposal of such disputes does not clothe it with the power to dispose of the complaint by summary adjudication, without affording reasonable opportunity to lead evidence or prove documents."

The court emphasized that while consumer forums are meant for speedy redressal, they cannot bypass principles of natural justice. The insurance company had sought to produce:

- An OPD ticket (dated 2010) showing the deceased was treated for Rheumatic Heart Disease before taking the policy.

- Testimony of an investigator who verified the medical history.

- Examination of the treating doctor.

Despite multiple opportunities, the Commission closed the insurer’s right to present evidence, leading to a one-sided decision. The High Court found this approach flawed, stating:

"These aspects were required to be evaluated by the Commission by way of evidence, but it has proceeded to allow the claim merely on the strength of the sole statement of the respondent."

The court highlighted that under the Consumer Protection Act, 1987 (applicable due to transitional provisions under the J&K Reorganization Act), consumer forums have powers similar to civil courts, including:

- Summoning witnesses

- Examining evidence

- Ensuring both parties get a fair hearing

Since the Commission failed to discharge these duties, the High Court remanded the case for fresh consideration, directing:

- The insurance company must be allowed to present its witnesses.

- The claimant should also get a chance to rebut any new evidence.

Case Title: Met Life India Insurance Company Ltd vs Abdul Aziz Khan, 2025

Appearance:

- Mudasir-bin-Hassan, Advocate for Petitioners

- Ateeb Kanth, Advocate for Respondent