In a significant ruling reinforcing consumer rights in insurance disputes, the Jammu & Kashmir and Ladakh High Court has dismissed an appeal filed by National Insurance Company Limited, upholding compensation awarded to a Srinagar family whose house was damaged during the devastating September 2014 floods.

The court held that an insurance company cannot escape liability by relying on exclusion clauses that were never clearly disclosed to the insured.

Read Also:- Supreme Court Seeks CBI, ED Status Reports in Alleged ₹1.5 Lakh Crore Bank Fraud Linked to Anil

Background of the Case

The case arose from damage caused to a residential house located at Sarai Payen, Amira Kadal, Srinagar, during the 2014 floods. The property was insured with National Insurance Company under a policy that had been renewed continuously since 2009.

The insured, late Shad Mohd Bashir, had taken a Standard Fire and Special Perils Policy, which was valid during the flood period. After the floods caused substantial damage, the family filed a claim. A surveyor appointed by the insurer assessed the loss at ₹6.08 lakh.

However, the insurance company rejected the claim, citing an exclusion clause related to STFI risks (Storm, Tempest, Flood and Inundation).

The matter was taken to the Jammu & Kashmir Consumer Commission, which partly allowed the complaint and directed payment of ₹4.76 lakh, including litigation costs. The insurer then challenged this order before the High Court.

Read Also:- Leopard Attack or Murder? Bombay High Court Grants Bail to Key Accused in Shocking Yavat Killing Case

Insurance Company’s Argument

Before the High Court, National Insurance argued that:

- The policy was a renewal of earlier policies where STFI risks were excluded

- The insured was aware of the exclusion

- No extra premium had been paid for flood coverage

- The Consumer Commission wrongly presumed coverage

- The claim was lawfully repudiated

The insurer also relied on Supreme Court rulings to argue that courts cannot rewrite insurance contracts.

Court’s Observations

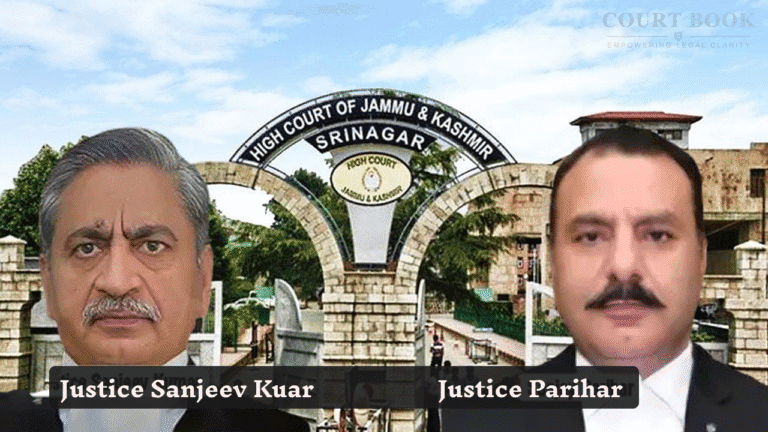

The division bench of Justice Sanjeev Kumar and Justice Sanjay Parihar closely examined the policy terms, past renewals, and the conduct of the insurer.

Read Also:- Bombay High Court Dismisses Plea Against PSU Banks’ Right to Reject Candidates for Past Misconduct

The court noted several key facts:

- The policy was titled “Standard Fire and Special Perils Policy”, which normally includes flood-related risks

- The insurer failed to produce the original proposal form

- There was no proof that the exclusion clause was ever explained to the insured

- The insurer could not show that the insured knowingly agreed to exclude flood coverage

The bench made a crucial observation:

“A consumer cannot be expected to understand technical expressions like ‘STFI’ unless the insurer clearly explains them.”

The court also referred to Supreme Court rulings which state that insurance contracts are based on utmost good faith, meaning the insurer has a duty to clearly disclose exclusions.

Read Also:- Bombay High Court Dismisses Plea Against PSU Banks’ Right to Reject Candidates for Past Misconduct

Consumer Protection Emphasised

The court rejected the argument that repeated renewals automatically mean consent to exclusions. It observed that insurance policies are standard-form contracts where the consumer has little bargaining power.

Citing consumer protection principles, the bench noted that:

- Exclusion clauses must be clearly disclosed

- Ambiguous or hidden exclusions cannot defeat legitimate claims

- Insurers must act fairly and transparently

The court also pointed out that the insurer failed to comply with IRDA regulations, which require clear disclosure of policy terms.

Final Decision

Upholding the Consumer Commission’s order, the High Court ruled:

- The insurer failed to prove that flood exclusion was disclosed

- The policyholder could not be denied compensation

- The appeal lacked merit

The court dismissed the appeal and directed the insurer to:

- Pay ₹4,56,347 as compensation

- Pay ₹20,000 as litigation costs

- Pay interest as ordered if payment is delayed

“The findings of the Consumer Commission suffer from no illegality,” the court held while dismissing the appeal.

Case Title: National Insurance Co. Ltd. vs Mala Bashir & Ors.

Case No.: FAO(D) No. 13/2024

Decision Date: 4 December 2025