In a significant ruling, the Supreme Court of India on Wednesday enhanced the compensation awarded to the family of a young engineer who died in a road accident, faulting the Patna High Court for slashing the amount by almost half. The apex court observed that the High Court wrongly excluded salary allowances and made an arbitrary 30% income tax deduction while computing the compensation.

Background

The case arose from the tragic death of a 27-year-old Power Grid Corporation engineer, whose family - led by his mother, Manorma Sinha - had approached the Motor Accident Claims Tribunal in Muzaffarpur. The Tribunal, after considering the deceased’s income, had awarded compensation of ₹88.20 lakh with 6% annual interest.

However, the Patna High Court drastically reduced the amount to ₹38.15 lakh in 2022, reasoning that certain allowances could not be included in the salary and that 30% of the income must be deducted towards tax. Feeling aggrieved, the family appealed to the Supreme Court, contending that the High Court’s calculation was not only unfair but contrary to established legal principles.

Court’s Observations

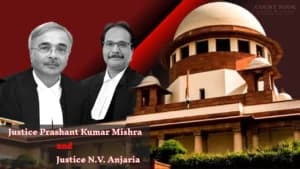

A Bench of Justices P.S. Narasimha and Manoj Misra restored the compensation logic applied by the Tribunal, emphasizing that “income includes all monetary benefits and perks received by the employee, not just the basic salary.”

The bench observed, “The High Court erred in excluding allowances from the computation of income. As held in previous judgments, the term ‘income’ must be understood broadly, considering the economic reality of the family dependent on the deceased.”

The Court relied on earlier rulings, including National Insurance Co. Ltd. v. Indira Srivastava (2008) and Vijay Kumar Rastogi v. UPSRTC (2018), which clarified that allowances and other benefits are integral to income for compensation purposes.

On the issue of income tax deduction, the Court found the High Court’s 30% flat deduction “unwarranted and unrealistic.” Justice Misra noted that tax must be calculated as per the actual tax slabs applicable in the year of death (2011) - which, in this case, led to a much smaller deduction of about ₹62,000.

The Court also restored the 50% addition towards future prospects, observing that since the deceased was a permanent employee below 40 years of age, the Tribunal was right in applying that rate.

Decision

Setting aside the High Court’s order, the Supreme Court enhanced the compensation to ₹74.43 lakh with 6% interest per annum, payable from the date of the original claim.

In conclusion, the bench remarked that the High Court’s approach was inconsistent with established law and caused “unjust reduction” in the rightful entitlement of the victim’s family.

The judgment, delivered on October 15, 2025, serves as yet another reminder of the judiciary’s consistent stand that compensation in motor accident cases must reflect both fairness and economic realism.

Case: Manorma Sinha & Anr. vs The Divisional Manager, Oriental Insurance Co. Ltd. & Anr.

Citation: 2025 INSC 1237

Case Type: Civil Appeal (arising out of SLP (C) No. 19878/2022)

Date of Judgment: October 15, 2025