The Bombay High Court has refused to interfere with a Motor Accident Claims Tribunal (MACT) award granting nearly ₹3 crore in compensation to an Air India cabin crew member who suffered 100% permanent disability in a road accident over a decade ago. Dismissing the appeal filed by HDFC Ergo General Insurance Company, the court made it clear that minor inconsistencies in testimony cannot override strong medical and documentary evidence.

Background of the Case

The case arose from a road accident that took place on 18 November 2014 at Prabhadevi, Mumbai. The victim, Adil Lutfi Peters, was riding his two-wheeler and wearing a helmet when a speeding car allegedly rammed into him.

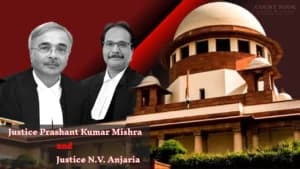

Read also:- Supreme Court Revives Criminal Case in Property Deal, Says Forgery Claims Need Trial

At the time of the accident, Peters was 53 years old and working as a cabin crew member with Air India, earning around ₹2 lakh per month along with allowances. The collision left him with catastrophic injuries, resulting in 100% permanent disability.

He approached the Motor Accident Claims Tribunal seeking compensation. After examining oral and documentary evidence, the Tribunal in March 2025 awarded him ₹2,97,89,800 with 7% annual interest, holding the car driver and insurer jointly liable.

Insurance Company’s Challenge

HDFC Ergo challenged the MACT award before the Bombay High Court under Section 173 of the Motor Vehicles Act, 1988. Notably, the insurer did not dispute the amount of compensation.

Read also:- Upholds Father’s Conviction in Minor Daughter Rape Case: Delhi High Court

Instead, the appeal focused only on negligence. Senior counsel for the insurance company argued that there were contradictions in the claimant’s statement, particularly about whether the car hit him from the front or rear. According to the insurer, this inconsistency weakened the Tribunal’s finding on rash and negligent driving.

Court’s Observations

A division bench comprising Chief Justice Shree Chandrashekhar and Justice Gautam A. Ankhad carefully examined the record and rejected the insurer’s argument.

The bench observed that proceedings under the Motor Vehicles Act are summary in nature and aimed at awarding “just compensation.” The court noted that the Tribunal is not bound by strict rules of pleadings or technicalities.

“The function of the Tribunal is to determine fair compensation once an accident is established,” the bench observed, adding that minor contradictions do not automatically discredit a victim’s entire testimony.

The court also emphasized that police records, including the FIR and charge-sheet, supported the claimant’s version of events. Medical evidence, particularly the disability certificate proved by the doctor who testified before the Tribunal, remained unshaken during cross-examination.

No Scope for Appellate Interference

The High Court underlined that appellate courts should not interfere with factual findings unless there is a clear legal error or complete absence of evidence.

Read also:- Gazette Publication Is Mandatory for Trade Curbs, Rules Supreme Court in Steel Case

“Not every mistake, even if assumed, lays a foundation for interference,” the bench noted, holding that the alleged contradiction did not strike at the root of the case.

The judges further remarked that inconsistencies become material only when they shake the very foundation of the judgment — a threshold not met in this case.

Final Decision

Finding no substantial question of law, the Bombay High Court dismissed HDFC Ergo’s appeal. The court also imposed litigation costs of ₹2 lakh on the insurance company, payable to the accident victim in addition to the awarded compensation.

The court declined the insurer’s request for a four-week stay on the judgment and allowed the claimant to withdraw the deposited amount. With this, all pending interim applications were disposed of as infructuous.

Case Title: HDFC Ergo General Insurance Co. Ltd. vs Adil Lutfi Peters & Anr.

Case Number: First Appeal No. 1763 of 2025

Date of Judgment: 6 January 2026