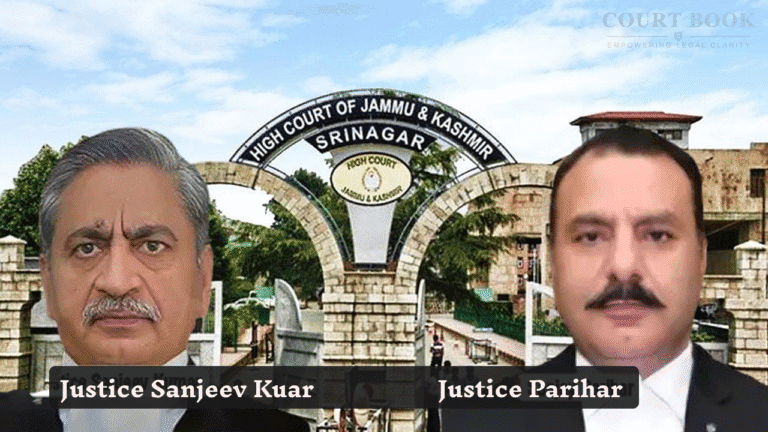

At the Srinagar wing of the Jammu & Kashmir and Ladakh High Court, a bench comprising Justice Sanjeev Kumar and Justice Sanjay Parihar on Thursday dismissed an appeal filed by National Insurance Company Limited. The insurer was seeking to overturn a compensation award granted to a family whose home was damaged during the devastating 2014 floods.

Background

The case originates from a policy taken by late Shad Mohd Bashir, whose residential house at Sarai Payeen, Amira Kadal, Srinagar, had been insured since 2009. Though the policy was renewed annually, the company later claimed that it excluded flood and similar storm-related risks - referred to in technical jargon as “STFI” (Storm, Tempest, Flood, Inundation).

The family, now represented by his legal heirs, approached the Consumer Redressal Commission after their house suffered extensive damage in September 2014.

The Commission found merit in their plea and awarded ₹4,76,347, accounting for assessed damages and litigation costs, with interest in case of delayed payment. The insurer challenged this before the High Court.

Court’s Observations

During the hearing, an interesting point played out: the Court noted that the insurer could not produce the original proposal form - the main document through which a policyholder is supposed to consent to exclusions.

The bench emphasized that ordinary policyholders cannot be expected to decode tricky acronyms like STFI or be aware of what is included or left out unless such exclusions are clearly brought to their notice.

“The insurer must clearly inform the insured of material terms,” the judges remarked, relying on Supreme Court precedents like Manmohan Nanda and Texco Marketing, which stress fairness and transparency in insurance contracts.

Another key observation: the policy itself was marketed as a “Standard Fire and Special Perils Policy”, which ordinarily covers floods and similar calamities. That, the Court felt, would give consumers a reasonable expectation of protection against natural disasters exactly the sort of peril the floods posed in 2014.

“The insurer cannot rely on a concealed exclusion clause to defeat the consumer’s legitimate expectations,” the bench noted.

Decision

Finding no flaw in the consumer forum’s approach, the judges held that the insurer failed to prove that the exclusion was ever properly explained to the insured. Accordingly, the appeal was dismissed as “without merit”. The insurer has been directed to satisfy the awarded amount, including interest if delayed.

The statutory deposit will be transferred for release to the respondents, meaning the family should finally receive compensation - more than a decade after the floods turned their home into a wreck.

Case Title:- National Insurance Company Ltd. v. Mala Bashir & Others

Case Number:- FAO(D) No. 13/2024